25+ Mortgage borrowing salary

Credit card interest rates. Your salary is certainly an important element in assessing how much you can borrow but so are a number of other factors.

Sample Pay Off Letter Geluidinbeeld With Payoff Letter Template 10 Professional Templates Ideas 10 Professional Payoff Letter Loan Payoff Mortgage Payoff

500 a Month Mortgage.

. Proof of self-employment eg recent CRA My Account Assessment or recent NOA and corresponding T1 General 4-page summary. Eligible refinancers borrowing. The APR cannot increase by more than 1 each quarter over the previous quarter and cannot exceed 18.

By salary sacrificing your home loan repayments you pay your mortgage in pre-tax dollars saving you serious money. When the Salary Advance Cash Account balance is less than 500 the loan margin is 1175. Levels such as mortgage borrowing credit card and personal loan limits.

Enjoy special discounts on car rentals of up to 25 at. You may also need to be able to afford to put down a larger deposit for a BTL property. 400 a Month Mortgage.

The property initially costs you 100 per week out of pocket. Otherwise the Society operates a maximum 25 exposure to any one development. One discount point equals 1 of the mortgage amount and may reduce the loan amount by 0125 to 025.

25 The total invested is 125 Salary sacrifice Employee agrees to reduce monthly pay before deductions by 14981 Employer pays into employees pension salary. If you choose to use lenders mortgage insurance to increase your borrowing power you can choose to add it to the loan balance though keep. This is the rate the borrowers monthly payment is based on.

Basic salary including any employed. Interest rate relates to the cost of borrowing stated as a percentage on the principal amount of a mortgage. You can save NIC of 1325 of the amount sacrificed on earnings above the primary threshold 12570 for tax year.

Attention borrowing money also costs money. This comparison rate is true only for examples given and may not include all fees and charges. 300 A Month Mortgage.

The ING Mortgage Loan the ING Bridging Loan and the Mortgage loan combined are mortgage loans subject to the law of April 2016 concerning mortgage loans. The Bank has previously indicated that about 6 of mortgage borrowers approximately 35000 people would have been able to secure a bigger home loan if the interest rate stress test had not. The Comparison rate is based on a 150000 loan over 25 years.

When the Salary Advance Cash Account balance is equal to or greater than 500 the loan margin is 525. You may also find it difficult to secure a buy-to-let mortgage if youre too old. Did you know that salary sacrifice also known as salary exchange SMART Pensions and Smart.

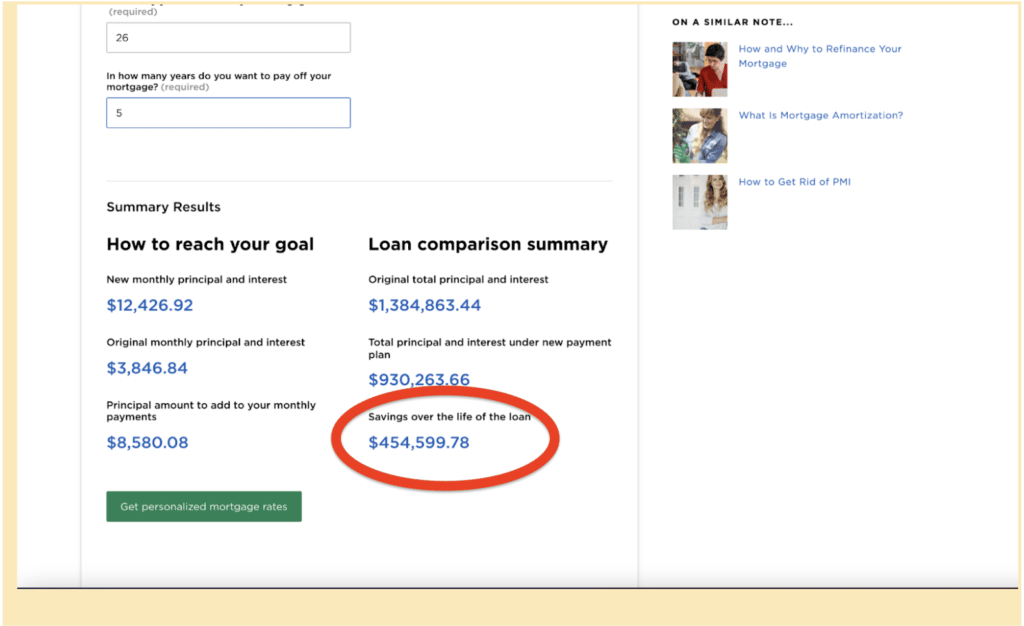

Restrict your additional loan term to your current mortgage term. Be one of the high-borrowing 15. Different terms fees or other loan amounts might result in a different comparison rate.

Where Shared Ownership is a subset of a larger development we will lend on the greater of 25 or up to 10 of the Shared Ownership properties. Borrowing Based on Salary. Can you salary sacrifice your mortgage.

This comparison rate is true only for. Your main annual income gross eg. Use Mortgage Choices borrowing power calculator to work out how much you can borrow for your home loan.

By entering the length of the mortgage your salary plus additional salary if youre looking to co-purchase your expenses and the number of any dependants you may have the calculator. Use How Much Can I Borrow calculator to know your borrowing capacity to pay for your mortgage personal or home loan based on your income expenditure. Many lenders expect landlords to be earning at least 25000 a year.

Fill in some simple details find out today. 600 a Month Mortgage. Earning a tax refund through negative gearing.

High-street lenders offer 55 times salary mortgages up to 85 LTV. Usually this needs to be 25-30 higher than your mortgage payment. Loan term and LVR as input by the useryou.

You are also much more likely find a lender who will provide you a mortgage if your salary is over a certain amount. What is the difference between interest rate and APR on a mortgage. No additional borrowing re.

After your tax refund of 9625 the actual cost is just 375. Maximum additional loan term is 25 years if any element of your mortgage is on interest only. APR measures both the interest charged as well as any.

Other possible impacts are on your borrowing levels such as mortgage borrowing credit card and personal loan limits income. Savings account interest rates. Find out more.

A lender we work closely with has recently announced a mortgage for 7x your salary for suitable candidates. Contrary to popular belief there is no rough calculation or rule around this. Offer reserved for natural persons over the age of 18 and subject to prior acceptance of your application by ING Belgium and to mutual agreement.

The comparison rate for the relevant product is based on a loan of 150000 over a term of 25 years. Borrow 7x Your Income. Require you to put the new borrowing on a separate mortgage rate which is likely to mean arrangement andor booking fees need to be paid these can cost 100s.

Read more about it here. For example your salary has fallen or you have more debt or outgoings now this could also hurt your chances. Let us know a bit about your mortgage and your spending to see what extra we may be.

Many lenders set upper age limits usually at 70 or 75 years old. Interest rates and annual percentage rates. For example two points on a 200000 mortgage are 2 of the loan amount or 4000.

You can therefore claim 250 per week against your income tax. If you are paying tax at the rate of 37 15 medicare levy you would receive a tax refund of 9625 per week.

Ways To Pay Off Your Mortgage Early And Why We Did It

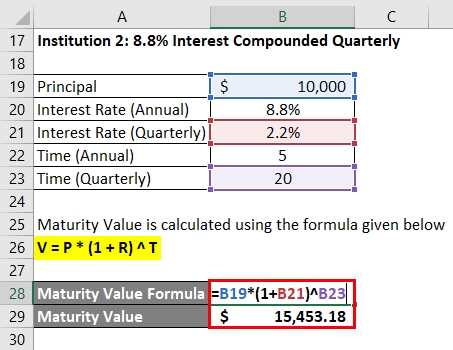

Maturity Value Formula Calculator Excel Template

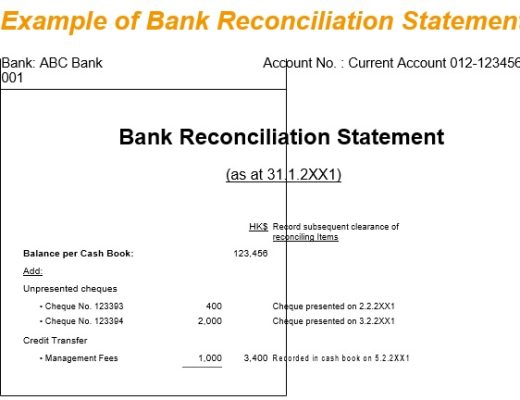

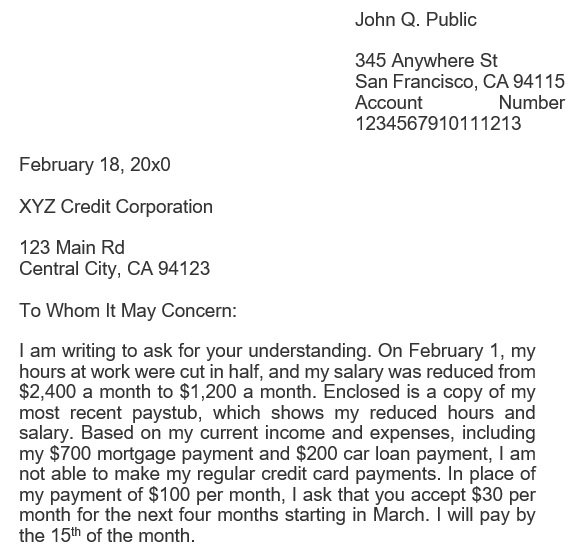

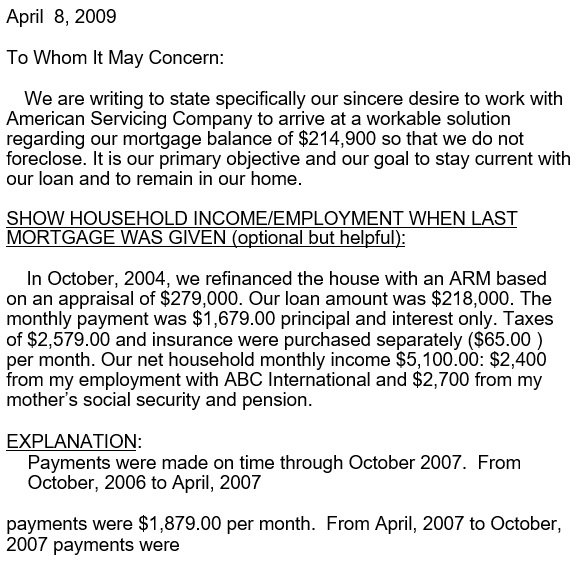

25 Letter Of Explanation Templates For Mortgage And Derogatory Credit Word Best Collections

Ways To Pay Off Your Mortgage Early And Why We Did It

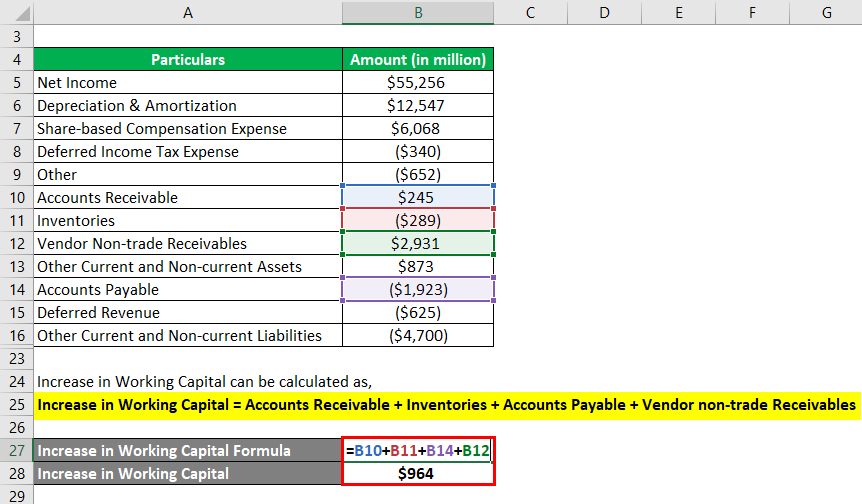

Operating Cash Flow Formula Examples With Excel Template Calculator

Ways To Pay Off Your Mortgage Early And Why We Did It

Increasing Passive Income Through Leverage And Arbitrage

Rick Rozman Owner Provider Of Low Cost Mortgages Exact Mortgage Inc Linkedin

25 Cash Advance Apps Like Moneylion Say Goodbye To Payday Loans In 2022

25 Letter Of Explanation Templates For Mortgage And Derogatory Credit Word Best Collections

25 Letter Of Explanation Templates For Mortgage And Derogatory Credit Word Best Collections

25 Letter Of Explanation Templates For Mortgage And Derogatory Credit Word Best Collections

:max_bytes(150000):strip_icc()/preapproved_mortgage_FINAL-22c6cd19ccd34815a10baa195848112d.png)

5 Things You Need To Be Pre Approved For A Mortgage

Bootstrap Client Or Partners Logo Showcase Example Clients Templates Template Design

Bootstrap Client Or Partners Logo Showcase Example Clients Templates Template Design

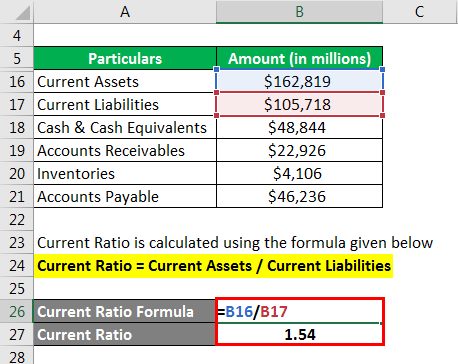

Ratio Analysis Formula Calculator Example With Excel Template

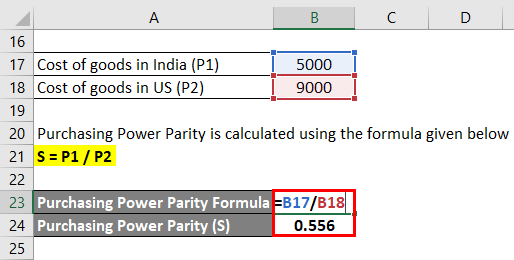

Purchasing Power Parity Formula Calculator Excel Template